Click on the play button

to play video.

Creating Income & Cashflow Through Industrial Real Estate.

Founded in 2015, InvestPlus Real Estate Investment Trust is a private real estate investment fund based in Calgary, Alberta. The REIT provides an opportunity for investors to participate in the industrial real estate market across Western Canada without the responsibility of having to own or manage a building themselves.

Why Industrial?

There is a growing demand for industrial due to the need for low cost and efficient space for businesses that have traditionally been in office or retail centres. In many cases, industrial provides similar benefits to office and retail for tenants while keeping operating costs much lower. In addition, with the growing shift toward e-commerce, distribution centres are also adding significant demand for industrial space in Canada. Adding all this together result in higher yields which in-turn provide a consistent distributions for our unit holders.

The majority of our tenants operate internationally within the transportation, e-commerce, energy sectors and distribution services.

Tenants-First Philosophy

At InvestPlus REIT, our tenants are the #1 asset. Whether our tenants are looking to grow locally or nationally, we’re prepared with real estate solutions to grow alongside them. Tenants shouldn’t have to start over from square one when they relocate or expand to a new region. We consistently and successfully create long-term relationships by being their one-stop shop for real estate.

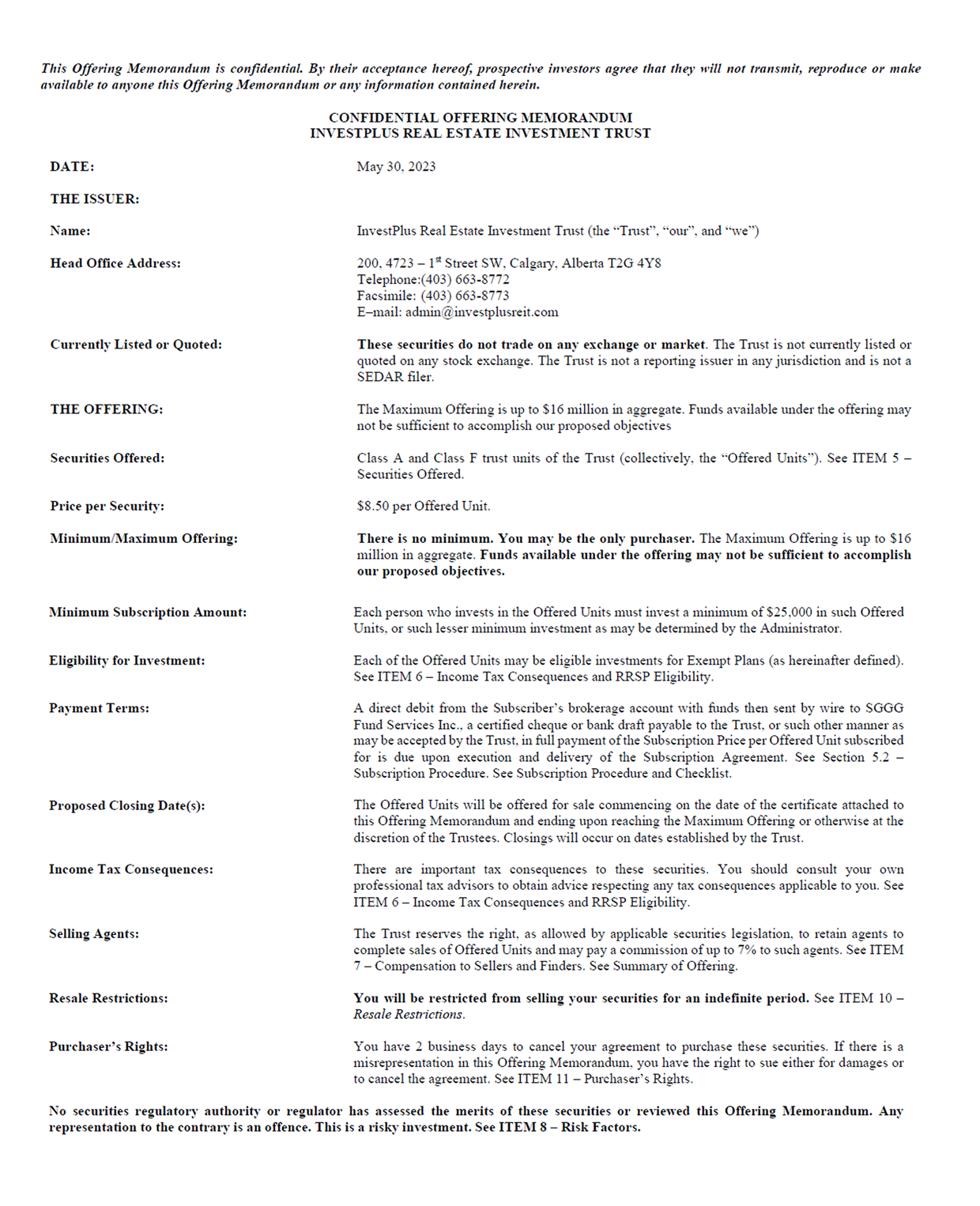

InvestPlus Real Estate Investment Trust (IP REIT) is a private real estate investment fund, based in Calgary, Alberta. The REIT provides an opportunity to invest in a diversified portfolio of multi-unit residential apartment and commercial buildings in western Canada. Our mandate is to provide you with the most attractive, wellstructured, and ethical real estate investment in Canada.

Book a Discovery Call with our

Licensed Exempt Market Dealer

Book a Discovery call with one of our Licensed Exempt Market Dealer who will educate you on the Private Markets and some of the many Private Real Estate, Equity & Debt Firms (like the InvestPlus REIT) that might be of interest from a suitability, concentration and diversification perspective for a portion of one’s portfolio.

Company Key Performance

Our Portfolio

Portfolio Revenue by Tenant

Book a Discovery Call with our

Licensed Exempt Market Dealer

Book a Discovery call with one of our Licensed Exempt Market Dealer who will educate you on the Private Markets and some of the many Private Real Estate, Equity & Debt Firms (like the InvestPlus REIT) that might be of interest from a suitability, concentration and diversification perspective for a portion of one’s portfolio.